Ahkam in Brief – Purchase and Sale

[The Script]

A big part of our everyday time is utilized in shopping or trading with others. Due to its importance, this concept is discussed thoroughly in the Islamic laws. In this episode we will discuss some of the rules related to purchase and sale .

According to the Islamic Laws, Selling, is the transfer of ownership of something, from one person to another for a certain price.

Firstly, let’s review the characteristics of both the buyer and the seller:

They should each be sane. So an insane person is not permitted to transact. For a person who squanders, there are special rules.

They should be at the age of puberty. In some specific situations selling to a minor is allowed. Like selling to an authorised minor.

They should be free and willing to trade.

They should be the owners or lawfully authorised to buy or sell the goods (like someone who has this right by proxy).

OK, now let’s review the conditions regarding the goods and what is obtained in exchange:

First, the quantity, amount, weight, specifications, price and whatever affects the value should be known to the buyer and seller.

Second, both (the good and what is exchanged) should be possessable and something that can be owned. For example, a fish while freely swimming in the ocean can’t be sold or purchased.

Third, both (the good and what is exchanged) should be transferable. So what’s lost or stolen can’t be traded.

Now, after knowing the conditions, we will commence a purchase. The essential steps according to the Islamic laws are:

The first step is that the buyer and seller have to specify the goods and the price. For example, this book for 1000 dinars. The price could also be something else we exchange in return, for example this book for 10 pencils.

The second step is the offer and the acceptance. This means one of them should offer this trade and the other one should accept it. Verbal utterance is not required, and any action that expresses such mutual consent is enough. Like when the customer picks up something and pays the money. The seller also takes the money from him and accepts it.

The third step is to exchange the goods and the price immediately after the agreement and on the same spot.

If they have both agreed to postpone the exchange, there are different rules to be followed.

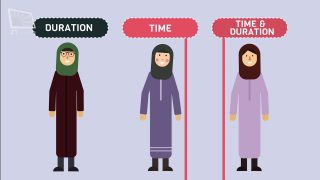

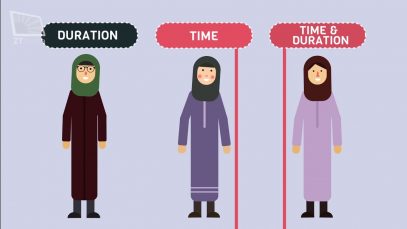

Depending on the type of the payment, delivery, and the type of the goods there are four types of contracts:

Cash contract: is if both agreed to exchange goods right after the agreement.

Credit sale: is if both agreed to immediately deliver the goods and postpone the payment. The date of payment should be clarified otherwise the contract will be void.

Advanced Payment Contract: Is the purchase of an item, where only the specifications are defined before the sale but not the exact item, and to be delivered later.

Sale of gold and silver against gold and silver: If gold is sold against silver, or silver is sold against gold, the transaction is valid. But they should be exchanged immediately after the agreement, otherwise it will become void.

Selling of gold against gold, or silver against silver, is only allowed if they are equal in the weight or amount.

An important note: did you know that there is a type of Haram Riba in purchase?

Riba doesn’t only occur in loans and interests. In some cases the purchase might be considered Riba which is Haram. For example, to sell a commodity which is sold by weight or measurement, at a higher rate against the same commodity, like selling 3 kilos of wheat for 5 kilos of wheat, even if their quality is different. This is considered Riba or usury and it is Haraam.

For more info please refer to the Islamic Laws book.

Question, is it possible to cancel a transaction? If yes, how?

If a purchase is done it cannot be cancelled except by the consent of both sides. In some specific situations the buyer or the seller can gain the option, or in Arabic “Khiyar”, of cancellation. Let’s briefly review them:

- Option in delay; if one party doesn’t pay or deliver on agreed time, the other party has the right to cancel.

- Option in Majlis or session; Both parties have the option to rescind the contract before they leave the contract assembly or session..

- Option in being wronged or defrauded; If someone by mistake sells something for a very cheap price or the customer buys something for a very high price compared to its common price or if deception has occurred, then the wronged party has the option to cancel. The wronged party should act as soon as he becomes aware of it.

- Option in observation; if the quality of goods at the time of delivery doesn’t match what one was informed or saw before, the customer has the right to cancel.

- Option in defectiveness; if the goods supplied, or what is paid in exchange is defective, either party has the right to cancel. The defect here should be something considerable and this option should be exercised as soon as one becomes aware it.

- Option in stipulated conditions: If both parties agree that one or both or a third party is be entitled to cancel the transaction within a limited time, then any party can cancel within that time frame

- And lastly if the sold or exchanged item in the transaction was an animal, the person who takes it has the right to cancel the transaction within three days.

Some Forbidden and Haram sales:

- It is Haram to sell beer, liquors or any intoxicants. Even selling grape fruit to someone who makes wine from it is Haram.

- Selling pigs, non-hunting dogs, and dead Najis animals is not allowed.

- Lottery tickets, gambling tools like dice and chess.

- Sale and purchase of things which are exclusively utilised for Haram acts, like Haram musical instruments is not allowed. Even selling raw materials to one makes them is Haram.

- Any trade with an oppressor such that it helps him in his oppression is not allowed.

- Selling the Quran to a non-believer person who intends to insult it is not allowed.

- And finally Ihtikar, which is monopolistically storing foods in order to control and raise the market price is Haram.

[The End]